Client Service Groups

Since 1959, in our commitment to excellence, we strive to become the leading accounting and business consulting firm in California, the South and Southwest, and globally in the Pacific Rim region, providing a wide range of services for credit unions, governments, non-profit organizations, and commercial enterprise. We believe that value can be delivered to our clients through service-oriented business partners who have a keen understanding of how to guide them through the processes of business life.

State and Local Government

SingerLewak’s government practice comprises approximately twenty dedicated professionals who are fully committed to serving our local governmental clients year-round. The efficiency and experience cultivated by this dedicated team ultimately benefit our clients by ensuring consistent procedures and timely deliverables.

Counties

- Benton County Oregon

- Morrow County Oregon

- Polk County Oregon

- Tillamook County Oregon

- Yamhill County Oregon

- Association of Oregon Counties

Cities/Towns/Villages

- Albany Oregon

- Brownsville Oregon

- Clatskanie Oregon

- Dallas Oregon

- Detroit Oregon

- Florence Oregon

- Happy Valley Oregon

- Idanha Oregon

- Lebanon Oregon

- Madras Oregon Molalla Oregon

- Mt Angel Oregon

- Newberg Oregon

- Scotts Mills Oregon

- Silverton Oregon

- Stayton Oregon

- Tillamook Oregon

- Tualatin Oregon

- Village of Corfu New York

- Village of Cuba New York

- Village of Depew New York

Special Districts

- Cresenta Valley Water District California

- Palo Verde Cemetery District California

- Palo Verde Irrigation District California

- Clackamas Fire District Oregon

- Dallas Cemetery District Oregon

- Fairview Water District Oregon

- Hood River Park and Recreation District Oregon

- Keizer Fire District Oregon

- Netarts Water District Oregon

- Northwest Senior and Disabled Services Agency Oregon

- Oceanside Water District Oregon

- Tillamook County Transportation District

- Yamhill Communications Agency

Supporting Staff

- Marlene Frazier

- Heather Robinson

- Nate Cantonwine

Staff:

- Raushell Palmer

- Joe Cassidy

- Preston Herring

- Carlie Dossman

- Domnika Shadrin

- Sean Chamberlin

- Nolan Baier

- Austin Albin

- Lyle Foster

- Jonathon Miller

- Dulce Perez

Not-For-Profit Organizations

At SingerLewak, we recognize that every nonprofit organization’s mission is unique. Our success lies in our commitment to thoroughly understanding your organization, allowing us to tailor our service delivery approach to meet your specific needs and goals.

Our team of experts serve social service organization, educational institutions, foundations, religious organizations, association and membership organizations, museums and cultural institutions

Audit and Assurance

We tailor our service approach to address the issues that are important to our clients organizations and their stakeholders.

Our team of experts perform financial statement audits, single audits, employee benefit plan audits, and audits of internal controls.

Tax Services

At SingerLewak, you can rely on our specialized tax services for nonprofit organizations. Our team includes 5 tax partners, 3 directors, and 80 experienced staff, all trained to handle unique nonprofit tax issues. We prepare nearly 300 exempt organization tax returns annually, ensuring compliance with the redesigned federal Form 990, which serves both as a self-auditing tool and a public relations vehicle.

Our tax specialists have extensive experience with leading charitable organizations in Southern California. We assist with complex issues such as unrelated business income tax, governance, officer compensation, sponsorships, and fringe benefits. Trust us to provide the expertise you need for accurate and effective tax reporting.

What Sets Us Apart

We work with our clients to ensure they are in compliance with matters affecting their tax-exempt status.

Our team of experts can assist you with Form 990, charitable registration, unrelated business income, sales and use tax, state and local tax, property tax, international tax, tax consequences for executive compensation, and employment tax.

We will work with you to ensure you are informed of current trends and changes in tax law.

Advisory

Let us help you navigate complex challenges and opportunities so you can continue serving the community.

Our services include indirect cost allocations, cash flow planning, budget preparation, planned giving, capital campaigns, board training, CFO advisory, digital transformation, cybersecurity and risk management.

Individuals

At SingerLewak we know the importance of relationships in serving Individuals and meeting their needs for financial controls, stability and simplicity. We have extensive experience providing business management and tax services to Individuals, their families and family businesses.

Experience and Reputation

Specialized Individual Services

- Income Tax Planning and Preparation

- Business Management

- Estate Planning

- Financial Reports and Bookkeeping Services

- Analysis of Business Transactions

- Succession Planning

- Charitable Giving

- Retirement Planning

- Insurance Analysis and Risk Management

- Litigation Support Consulting

- Business Valuations

Key Industries

- Entertainment

- Entrepreneurs

- Real Estate

- Corporate

- Trust Fund

Cost- Effective

- We create fee structure based on our clients’ needs and a customized relationship plan

- We build payment plans that address our clients’ cash flow needs

Pension and Benefit Plans

Our dedicated team excels in guiding clients through the intricate landscape of employee benefit plan technicalities and compliance. Whether it’s a 401(k) Plan, defined benefit plan, ESOP plan, 403(b) plan, health & welfare plan, or a complex multiple employer plan, our seasoned partners bring over 20 years of expertise to the table. We’re adept at catering to the needs of small plans with as little as $100,000 in assets, as well as large plans with over $3,000,000 in assets.

First Year Audits

Preparation for First Audit: Assist clients in preparing for their first audit by reviewing current payroll, HR, and 401k administration processes.

Internal Controls: Ensure the level of internal controls is sufficient.

Plan Document Review: Compare plan documents to ensure proper administration.

Recommendations: Offer recommendations to improve areas before the first audit.

Compliance Issues

Overcoming Compliance Issues: Help clients with delinquent Form 5500 filings, late participant contributions, compensation definitions, eligibility, loan terms, repayments, and other prohibited transactions.

Correction Programs: Guide clients through the IRS Voluntary Correction Program and the DOL’s Voluntary Fiduciary Correction Program.

Service Provider Changes

Terminating Plans: Assist clients with plan termination or merging plans into another.

Service Provider Changes: Help clients switch payroll providers, custodians, and plan investment advisors. Assist in the RFP process for new service providers.

Form 5500 & Audit Quality

Form 5500 Preparation: Assist in preparing and reviewing Form 5500 to ensure accuracy.

AICPA Audit Quality Center Membership: Meet the training, internal inspection, peer review, and other requirements of the AICPA Audit Quality Center. Audit over 120 employee benefit plans annually with a focus on cost-effective and efficient service.

International

When you’re looking to do business on an international stage, you need a team that is well-versed and highly experienced in international tax matters. You want experts who understand all the nuances of international tax compliance and can provide fast, comprehensive guidance in a practical and efficient manner. You also need a firm with a deep international network and extensive knowledge of best practices to ensure your business thrives globally.

International Services

SingerLewak’s International Tax practice brings together the breadth and depth of a large firm but with an entrepreneurial mindset and nimble culture. Our practice combines the sophistication and nimbleness of an entrepreneurial organization.

When you are looking to do business on an international stage, you want:

- A well-versed, highly experienced international tax team

- A team that understands all the nuances of international tax compliance issues

- Fast, comprehensive guidance in a practical and efficient manner

- A firm with a deep international network and knowledge of best practices.

Compliance and Advisory

We provide a wide variety of compliance and advisory analysis including:

- Structural decisions such as treaty interpretation

- Selection of the most tax-efficient entity

- Export incentives using an IC-DISC.

- In addition to guiding international entities and/ or individuals, our tax professionals can prepare compliance and disclosure documents for foreign business operations and foreign bank accounts.

Cross-Border Business

Trust our International Tax Group to Guide You with Your Cross-Border Business Structure

Our international tax services group will work closely with clients to understand their particular business situation. We will advise the best structure to set them up for success with international tax strategies and regulations. We believe businesses and individuals succeed with the right financial partner guiding them through the complex web of doing business on an international platform.

Asia Tax Services

Credit Unions

With decades of experience, we leverage our expertise to help credit unions navigate crucial business matters while ensuring compliance with essential regulations in audit, assurance, governance, risk, tax, and more.

Understanding Credit Unions

Our professionals have dedicated their careers to assisting the credit union industry. We help credit unions focus on what is important while understanding other issues that may be relevant to your credit union as it serves its membership.

Our firm has specialized professionals who not only understand the credit union industry, but who are experts in not-for-profit accounting and compliance, CUSO compliance and operations, for profit tax and accounting issues, government regulations (depending on your field of membership and community affiliations) to name a few.

A Proven Track Record

We are one of the fastest growing credit union practices in the United States, currently ranked as one of the top audit firms according to Callahan & Associates 2021 Supplier Market Share Guide for Accountants and Auditors.

We leverage decades of experience in working with credit unions to navigate important business issues, regulatory directives, and understanding the latest accounting and audit guidance in governance, risk, and tax matters.

Your Key Advisory Partner

We have been selected by credit unions as a key partner in ensuring that their audit and consulting needs are aligned with credit union objectives, challenges, or management/Supervisory Committee concerns.

We have achieved trust in our clients through growing deep working relationships. Many of our credit union clients ask us to assist them with strategic, management, risk and growth objectives beyond their audit needs including training of volunteers on Financial Literacy, Examination Preparedness and Governance. .

This is because our understanding of credit unions goes beyond the norm. Many of our team have direct operational experience as former credit union leaders and employees, while the rest of our team has been serving credit unions for many years

Professional Affiliations

We actively participate and are leaders within many AICPA committees such as the AICPA Board of Directors, Technical Issues Committee, and are members of many state CPA societies. We participate in credit union industry groups and are sought to train regulators and examiners on important topics such as CECL and Credit Risk.

Investor Backed Businesses

SingerLewak assists companies supported by both venture capital and private equity firms in all facets of their business. Our services encompass advising on structuring and executing acquisitions, financing, and exit transactions, as well as offering transactional, general accounting, and comprehensive tax advice.

Private Equity

- Recapitalization

- Mergers and Acquisitions

- Traditional Leveraged Buy-Outs (LBO)

- Minority Investments

- Private Investment in Public Equities (PIPES)

- Mezzanine Debt

Venture Capital

- Venture Capital Investment

- Venture Debt

- Angel Investment

- Initial Public Offerings

- Mergers and Acquisitions

- Recapitalizations

Service You Expect

- Engagement terms intimately familiar with your industry issues and the venture capital ecosystem

- Experts in the key industries desired by venture capital and private equity: software and SAAS, life sciences, semi conducted hardware, internet and online media.

- Commitment to quick turnaround

- Technical reviewers who care as much about your judgement as they do their own

- Providing and adhering to a schedule of all key dates, deadlines and requirements related to our field work and tax filing requirements

- Robust staffing to meet any needs that may arise

Cost-effective

- We estimate fees based on a tailored risk-based audit; we don’t audit insignificant items

- We have a change order process that is built around early communication and client approval

SingerLewak serves companies backed by

both private equity and venture capital firms.

Portfolio companies benefit from our full breadth of services, including attest,

transactional, and tax advisory services.

We also advise companies on the

execution and financing of transactions, such as mergers or acquisitions.

Public Companies

Public companies are continuously being held accountable by the Securities and Exchange Commission, shareholders, analysts and other regulators to provide accurate financial reporting and robust disclosures.

Engaging with the right accounting firm is an important step in ensuring a public company complies with regulatory requirements and provides additional assurance that its financial statements can be relied upon.

PCAOB

SingerLewak is registered with the Public Company Accounting Oversight Board (PCAOB) and has a depth of experience servicing public companies. We provide our services to public companies that span a wide variety of industries within the United States and internationally. Our risk-based audit approach focuses on an efficient and effective process.

Services

- Financial statement audits in accordance with PCAOB standards

- Sarbanes-Oxley Section 404 compliance services

- Technical accounting assistance

- IPO readiness assistance

Transaction Experience

- Initial and secondary public offerings

- Mergers and acquisitions

- Private investment in public equities

Professional Affiliations

We actively participate and are leaders within many AICPA committees such as the AICPA Board of Directors, Technical Issues Committee, and are members of many state CPA societies. We participate in credit union industry groups and are sought to train regulators and examiners on important topics such as CECL and Credit Risk.

Closely Held Businesses

At SingerLewak, we deeply appreciate the significance of providing invaluable guidance and meeting the unique needs of entrepreneurs and their businesses. Our primary focus is to skillfully steer our clients towards achieving sustainable growth and their business objectives. By offering expert strategic advice, we enable you to concentrate on expanding your business while also assisting in maximizing cash flow for your enterprise.

Tax + Program

Our Tax + Program for Entrepreneur & Family-Owned Business Offers:

- Tax Planning

- State and Local Taxes (SALT)

- Tax Compliance and Consulting

- Multi-National Tax Planning

- Research & Development Credit Analysis

- Exit Strategy Planning

- Specialized Tax Credits

- Deal Structuring and Tax Planning for Sale of a Business

Business Growth

We are skilled at helping businesses grow to their fullest potential:

- Start-up services: Choice of Entity and Business

- Structuring Services

- Integrated Family/Business Tax Planning and Preparation

- Assistance with Capital Formation and Negotiating with Financial Institutions

- Back-Office Accounting Services

- Assistance with Advisory Boards and Strategic Planning

- IT and Systems Consulting

- Network Administration

- Audits, Reviews and Compilations

- Succession and Estate Planning

Private Businesses

We have extensive experience with privately-owned businesses, including:

- Assurance Services

- Income Tax Planning and Preparation

- Financial Planning

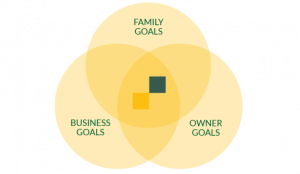

Dynamic Cycle

Managing a privately-owned business is a continuous and dynamic cycle, requiring:

- Business Strategies

- Wealth and Financial Management

- Tax Strategies

- Succession Strategies