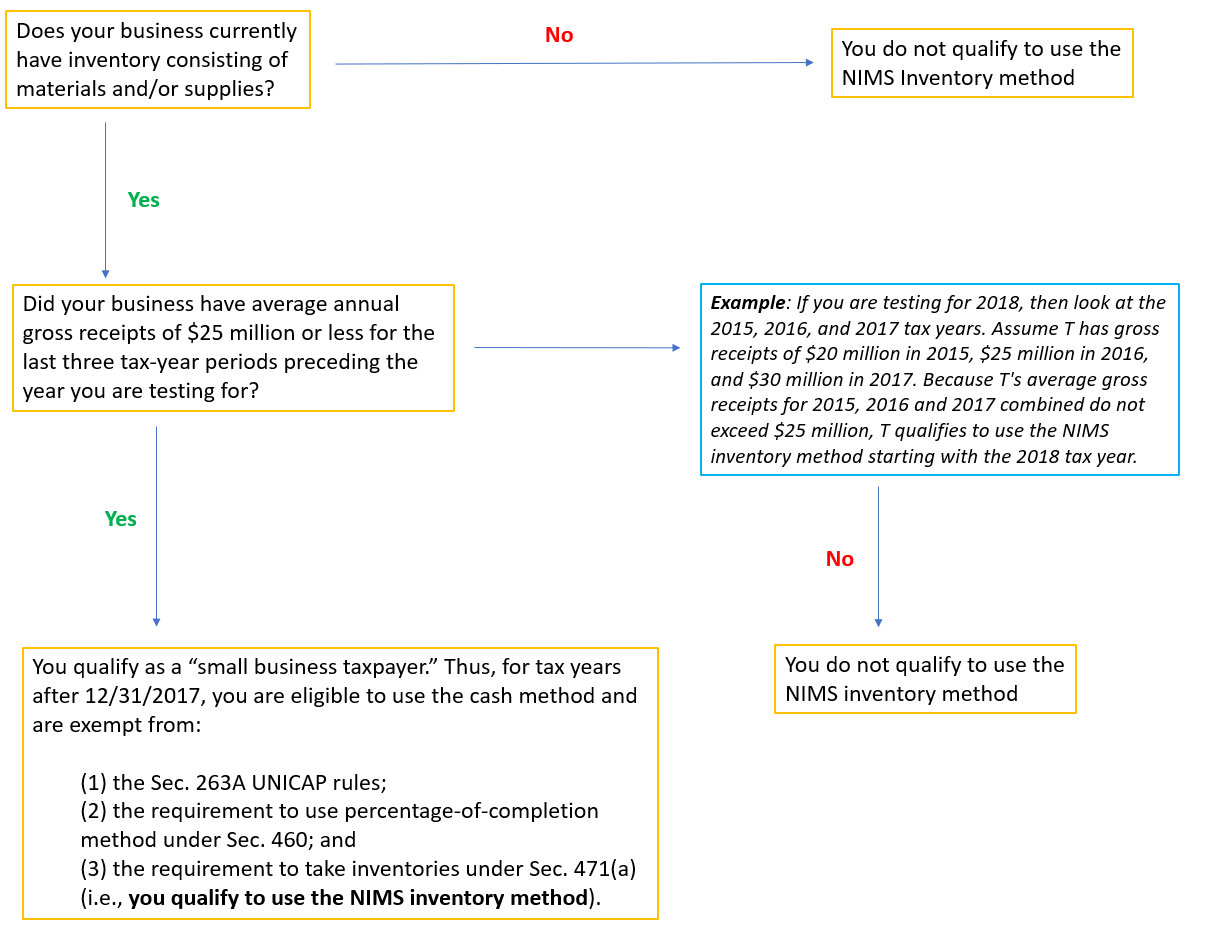

Generally, taxpayers are required to take inventories at the beginning and end of each taxable year. However, the TCJA and regulations provide an exception for certain “small businesses.” If your business qualifies, you may be able to treat certain costs as non-incidental materials and supplies (“NIMS”) instead of taking an inventory.

Under the NIMS inventory method, costs are deducted in the later of the year in which:

(1) the inventory is used or consumed in the taxpayer’s business (i.e., provided to a customer), or

(2) the taxpayer pays for (cash method) or incurs (accrual method) the cost of the item.

This method provides the following benefits:

- Only certain costs (i.e., direct material costs or the costs of property acquired for resale) need to be capitalized to inventory under the NIMS method; direct and indirect labor and overhead costs do not need to be capitalized.

- Taxpayers (other than tax shelters) that treat inventory as NIMS can use the cash method of accounting for purchases and sales of merchandise, instead of the accrual method.