Apr 15, 2019 | Audit, Center for Public Company Excellence, CFO Essentials, Public & Investor Backed

Written by: Elberta Nizzoli, Partner, SingerLewak In February 2018, the SEC issued Interpretive Release No. 33-1049 (Commission Statement and Guidance on Public Company Cybersecurity Disclosures), which provides interpretive guidance on disclosure requirements under...

Feb 20, 2019 | Audit, Public & Investor Backed

When the FASB issued ASU 2018-11, Leases (Topic 842), in July 2018, it was meant to reduce costs and ease the implementation of the leases standard. It provides a new transition method and a lessor practical expedient to not separate the lease and non-lease components...

Feb 6, 2019 | Audit, Entrepreneur & Family Owned Businesses, Family Owned Businesses

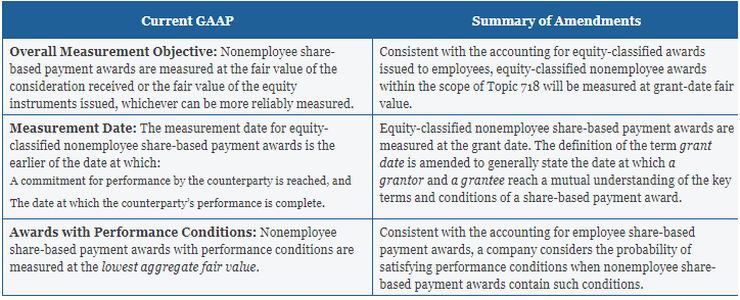

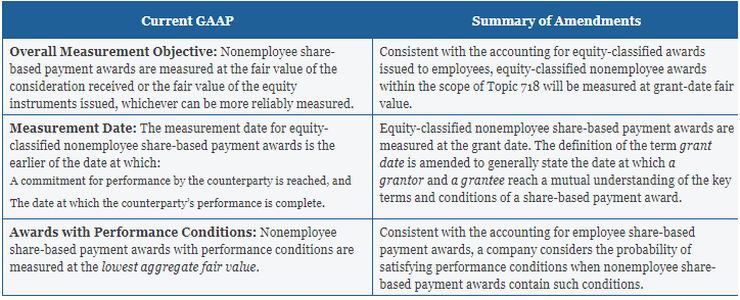

Update (ASU) 2018-07, Compensation—Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting. ASU 2018-07 is intended to reduce cost and complexity and to improve financial reporting for share-based payments to nonemployees (for...

Jan 30, 2019 | Audit, Center for Public Company Excellence, Revenue Recognition

On May 28, 2014, the Financial Accounting Standards Board (FASB) issued accounting standards update on revenue recognition, Revenue from Contracts with Customers (Topic 606). The guidance in the revenue recognition standard update affects entities that enter into...

Jan 15, 2019 | Audit, Public & Investor Backed, Revenue Recognition

On May 28, 2014, the Financial Accounting Standards Board (FASB) issued accounting standards update on revenue recognition, Revenue from Contracts with Customers (Topic 606). The guidance in the revenue recognition standard update affects entities that enter into...

Nov 5, 2018 | Audit, CFO Essentials

Author: Frances Franco, CPA, CFF, CVA : SingerLewak LLP Financial statements were once based primarily on historical costs. However, under certain circumstances, fair value accounting is the reporting standard. The objective of a fair value measurement is to estimate...