Update (ASU) 2018-07, Compensation—Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting. ASU 2018-07 is intended to reduce cost and complexity and to improve financial reporting for share-based payments to nonemployees (for example, service providers, external legal counsel, suppliers, etc.).

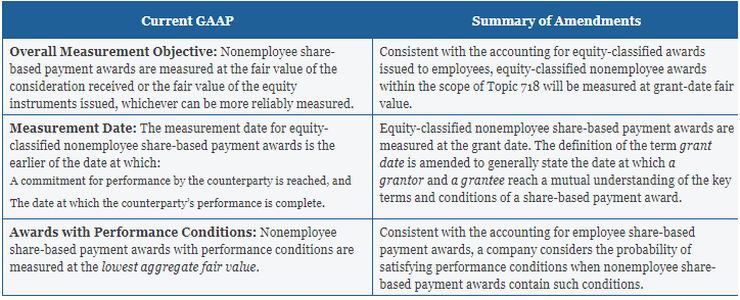

Basically, current GAAP has two different accounting models for share-based payments depending on whether such payments are issued to employees or nonemployees, and current GAAP for nonemployee share-based payments is significantly different from current guidance for employee share-based payments. ASU 2018-07 improves the accounting of nonemployee share-based payments issued to acquire goods and services used in an entity’s operations as shown in the following table:

ASU 2018-07 will be effective for public companies for December 31, 2019 financial statements and for nonpublic entities for December 31, 2020 financial statements. Early adoption is permitted, but no earlier than entity’s adoption date for ASC Topic 606, Revenue from Contracts with Customers.

Questions? Contact Jeremy Dillard at 818.251.1329, or via email at [email protected]