INTRODUCTION

In November, 2020, California voters passed Proposition 19, which modifies the application of the several current propositions. Proposition 19, which will become Sections 2.1, 2.2 and 2.3 of Article XIIIA of the California Constitution, affects certain types of real property transfers within California.

There have been a number of challenges to Proposition 13 over the years, but most have been unsuccessful. Proposition 19 is significant because it is one of the first successful challenges to the original proposition. Although there are a few benefits which assist parents and grandparents with base year transfers, it creates significant constraints on succession planning when transferring property to the next generation.

BACKGROUND

Article XIIIA of the California Constitution, otherwise known as Proposition 13, currently limits assessed values to a maximum 2% annual increase barring new construction and/or change of ownership. Shortly after enactment, California voters passed the following propositions to compliment Proposition 13:

- Propositions 58 and 193 – exclude transfers between parent and child (58) or grandparent and grandchild (193) from reassessment;

- Propositions 60 and 90, which allow homeowners who are 55 years of age to sell their primary residence and transfer the base year value of that property to a replacement residence if certain conditions are met. Proposition 60 applies to intra-county transfers, while Proposition 90 applies to inter-county transfers under certain conditions; and

- Proposition 110, which allows severely disabled persons to transfer the base year value of their primary residence to a replacement residence if certain conditions are met.

MOVING FORWARD – THE EFFECTS OF PROPOSITION 19

The Benefit.

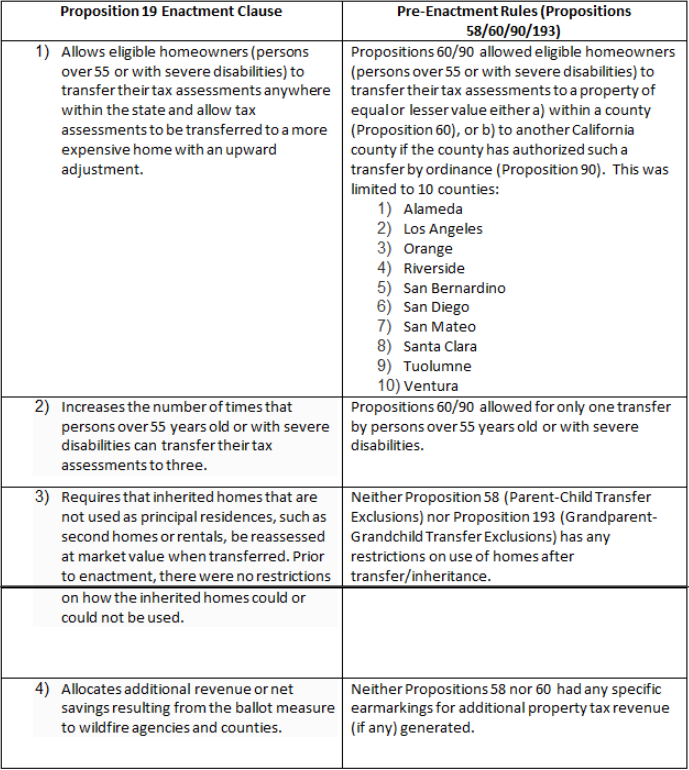

Homeowners wishing to transfer their property tax benefits to another home in California benefit in three separate ways:

- The transfer does not have to be to a property of equal or lesser value. A Homeowner purchasing a higher valued property could transfer prior benefit plus an upward adjustment;

- An intercounty transfer can occur between any two California counties and not just in 10 counties; and

- A qualifying transfer can be made up to 3 times, not just once.

The Cost.

Conversely, children/grandchildren who now inherit their parents’ principal or grandparents’ principal residence but choose not to make the home their principal residence will have the property re-assessed. This will affect many families, such as those with well-established family farms that have typically been handed down from generation to generation. If the child elects not to make the farm his or her principal residence, it is likely that the property could be reassessed to fair market value. This modification to fair market value can significantly affect the operations of the family farm as the value differences from base year 1975 properties to current value can be significant and can affect the ability of the farm to continue. For example, a family farm originally purchased for $300,000 (600 acres at $500 per acre) with a tax bill of approximately $3,500 could now be re-assessed at $6,000,000 (600 acres at $10,000 per acre; $$ per acre could vary depending on market area) resulting in a tax of approximately $72,000. This significant property tax increase could affect the family farm’s sustainability

TIMING

Proposition 19 affects Propositions 58 and 193 (Parent-Child, Grandparent- Grandchild) transfers made after February 15, 2021. Base Value transfers (Propositions 60/90/110) involving people over 55 or severely disabled are affected after March 31, 2021. Those who are concerned with re-assessment can complete a parent/grandparent-child/grandchild transfer by February 15, 2021 without re-assessment. Conversely, those qualified individuals wishing to transfer their property tax benefits to a more expensive home and/or to a county not previously listed under Proposition 90 may elect to delay closing the transfer until after March 31, 2021.

COMPARISON OF OLD AND NEW PROVISIONS

Questions or Comments? Please contact: [email protected]

Specialty Tax Lead Partner: Javier Ramirez

Director: Peter Seidel

Senior Manager: Tatyana Lirtsman