Governmental Accounting Standard Board (GASB) Statement No. 104, Disclosure of Certain Capital Assets, is a relatively short standard that includes requirements primarily over the classification and disclosure of certain capital assets. The Standard is effective for fiscal years beginning after June 15, 2025 (i.e., FY 2026 for June 30 year-end governments), but governments are encouraged to early adopt it.

The requirements in GASB Statement No. 104 can be summarized in two major topics. Those are, (1) the separate disclosure of certain capital assets, and (2) the classification and disclosure for capital assets held for sale.

Separate Disclosure of Certain Capital Assets

The following capital assets should be disclosed separately (by major class) from other capital assets, but within the detailed disclosure schedule of capital assets already required by GASB Statement No. 34, Basic Financial Statements—and Management’s Discussion and Analysis—for State and Local Governments:

- Lease assets reported in accordance with Statement 87, Leases,

- Intangible right-to-use assets recognized by an operator in accordance with Statement No. 94, Public-Private and Public-Public Partnerships and Availability Payment Arrangements,

- Subscription assets reported in accordance with Statement 96, Subscription-Based Information Technology Arrangements, and

- Intangible assets other than those within (a), (b), or (c).

Capital Assets Held for Sale

GSAB Statement No. 104 provides criteria to determine whether an asset is an asset held for sale. It also includes requirements regarding presentation and disclosure of assets held for sale.

Criteria

A capital asset is a capital asset held for sale if:

- the government has decided to pursue the sale of the asset and

- it is probable (likely to occur) that the sale will be finalized within one year of the financial statement date.

The Standard provides the following not all-inclusive factors to consider when evaluating whether it is probable that the sale will be finalized within one year of the financial statement date:

- Whether the asset is available for immediate sale in its present condition

- Whether an active program to locate a buyer has been initiated, which may include the asset being put out for bid

- Market conditions for selling that type of asset

- Regulatory approvals needed to sell the asset

Whether an asset meets the criteria of an asset held for sale is not a permanent determination. A government should evaluate whether a capital asset is a capital asset held for sale each reporting period.

Presentation (Classification)

A capital asset held for sale should continue to be reported within the appropriate major class of capital asset (i.e., land, building, equipment, etc.)

Disclosure

The note disclosure of capital assets held for sale (for each of governmental activities and business-type activities) should include:

- separate disclosure of historical cost and accumulated depreciation (or amortization), by major class of asset.

- the carrying amount of debt for which capital assets held for sale are pledged as collateral, for each major class of asset.

Illustrative Examples

Separate Disclosure of Certain Capital Assets

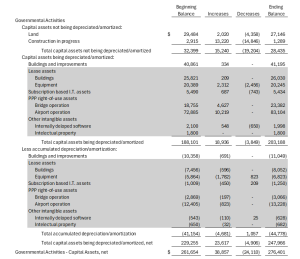

The following illustrative example highlights the effects of the disclosure requirements:

Capital Assets Held for Sale

Appendix C of the Standard provides the following illustrative example:

Included in capital assets are buildings that are capital assets held for sale. Those buildings are reported in governmental activities. They have a total historical cost of $8.0 million and an accumulated depreciation of $5.0 million, and they are pledged as collateral for debt with a balance of $1.5 million.

Final Thoughts

Even though the early adoption of this Standard would require retroactive application to all periods presented in the basic financial statements, the extent and complexity of the requirements in the Standard may not require significant effort from management. It could be a good opportunity for governments to early adopt it, as encouraged by the Standard.