Creating RIF-TS

What does the IRS Reduction in Force mean for you?

I am sure we have all heard by now of the plans to cut federal spending by significantly cutting the number of employees in many if not most federal agencies, and the Internal Revenue Service (IRS) is certainly no exception. On February 13, 2025, President Trump authorized the Department of Government Efficiency (DOGE) to audit IRS operations, and it is reported that DOGE has issued a reduction plan to agency leadership, though that plan had not been made public at the time of this writing. It is rumored to be somewhere between 20% and 50% as reported by various sources. The National Treasury Employees Union has confirmed that the IRS is planning for a “massive” layoff but has not indicated what exactly that number will look like [1]. Additionally, DOGE has identified over 100 IRS offices and service centers for potential closure after April 15th.

There is a lot of speculation about what a cut of this magnitude means for the IRS. Will it be good for taxpayers? For the Government? Our clients, like most Americans want answers now, but that is a question no one can definitively answer today. I even dusted off my old Magic 8 ball, but it kept telling me to ask again later. Hmmm. Since my feeble attempts at prognostication have failed, let’s do what accountants do best and look at the numbers.

In early January of 2025, at the end of former President Biden’s term, the IRS reported that it had grown its workforce to more than 100,000 total employees, which was more staff than the agency had since the mid-1990s. We do know as of the time of this writing, the IRS recently laid off approximately 6,700 probationary employees and another 4,700 employees have elected to accept the voluntary buy-out known as the “Fork in the Road” program offered by DOGE. Assuming the January staffing report count was accurate, the cuts that have already been made represent a reduction in force of approximately 11.4%. Another 20% reduction would drop IRS fulltime employees to around 70,000.

According to the historical statistics of income (SOI) reported on the IRS website [2], on September 30, 2003, the IRS had 89,767 employees. On that same date in 1995 they had 114,064 (as far back as the online data goes). The lowest number of employees reported during the tracking period was September 30, 2017 when the agency reported 72,803 employees. The predicted cuts will bring the IRS staff to levels unseen in more than 30 years.

In 1995, the IRS processed approximately 205,747,000 filings, reporting gross collections of $1,375,731,835,000. In 2017 those numbers were 245,411,588 filings, reporting $3,416,714,139,000 in gross collections. That averages to about 1,800 returns per IRS employee in 1995 vs. approximately 3,370 per employee in 2017 representing an 87% increase. Total filings and gross collections continue to trend upwards. In 2023 the SOI reported 271,484,482 filings representing $4,679,170,152,000 in gross collections. If we apply a reduced workforce estimated at 70,000 to those numbers, we are looking at another 15% increase in returns per employee.

One could argue that with the advent of electronic filing and technological advances, the processing of returns became easier for the IRS, creating capacity within the agency. Certainly, if we are comparing numbers from 1995 to 2017, that would be a fair point. In 1995 all returns were paper filed and hand keyed by IRS staff. By 2017, the majority of returns were efiled, mostly eliminating the hand key function.

However aside from efiling, other technological improvements have been slow to come to the IRS. According to the Government Accountability Office (GOA), “the IRS uses hundreds of applications, software, and hardware systems that are outdated – 25 years or older, or written in a programming language that is no longer used. Among these, one example stands out: the primary system the IRS uses to process individual taxpayer account data.” [3]

The original IRS system of automated data processing that helps the IRS with tax assessments, account updates and issuing refund checks was pioneered by the agency in the early 1960s. While the original system has been updated over the years, it still relies on a programming language designed in 1959 known as COBOL. In the GOA report released February 7, 2023 [4], 33% of applications, 23% of software and 8% of hardware currently in use by the IRS was considered “legacy” ranging from 25 to 64 years old. While the IRS has numerous modernization initiatives planned, implementation is hampered by staffing and funding challenges. Furthermore, since programming languages have evolved significantly, fewer programmers are fluent in COBOL adding to the complexity of modernization.

Also encumbering technological progress is the exceptionally large target the IRS presents for cyber-attacks and identity theft. Let’s face it, the IRS has all the goods. Names, addresses, social security numbers, dates of birth and bank and brokerage account numbers all in one convenient location. A hacker’s dream. 60-year-old systems don’t provide the security modern criminals are capable of exploiting. The threat also prevents the IRS from fully utilizing taxpayer-friendly digital options like cloud-based alternatives or even email. While the IRS launched online accounts for taxpayers in 2016, the capabilities available online are limited.

Of course, they have made it easy for taxpayers to pay their taxes online, but not so easy at all to get their held taxes refunded, to dispute an erroneous tax assessment, to amend a tax filing, or even to get clarification on an IRS notice. For that you have only two options: the telephone and paper correspondence.

In the 2022 Annual Report to Congress, the Taxpayer Advocate branch of the IRS noted the most severe problem encountered by taxpayers was paper backlogs causing refund delays for millions of taxpayers. The quote in the report is too good not to share:

“The IRS still depends on outdated manual practices and a human assembly line for its paper processing operations, and paper is its Kryptonite. For the past 2.5 years, millions of taxpayers have experienced significant delays waiting for the IRS to process paper-filed tax returns and issue corresponding refunds. These unprecedented paper processing and refund delays are the product of the IRS falling behind during the pandemic, combined with its reliance on antiquated processing technology and manual data entry. Collectively, this resulted in backlogs that overwhelmed the IRS and even caused it to have to transform a campus cafeteria, conference rooms, and hallways into makeshift paper storage space. The IRS needs to modernize its antiquated paper processing procedures to clear the paper backlogs, streamline processing for the future, and improve related taxpayer services and the taxpayer experience.” [5]

Kryptonite indeed. In 2020 and 2021, facing staffing shortages and technological challenges, the IRS was using every available inch of office space plus large storage containers in their parking lots to store all of the backlogged paper filed returns. If you mailed your return or correspondence during that time, you can bet it sat in one of these containers for what the report goes on to call an “unprecedented” amount of time. They tried to work through some of those problems through additional hiring, but it remained the most serious problem in the 2023 Annual Report to Congress.

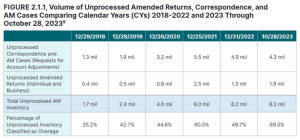

The 2023 Annual Report provided the following chart:

While the backlog clearly improved from its 2021 high, it still remained well above average in 2023, and that was with staffing numbers nearing 90,000.

It wasn’t just processing delays that frustrated taxpayers; it was lack of access to the agency. In the 2022 Annual Report both telephone and in-person service access and on-line access were listed in the top five most serious problems encountered by taxpayers.

The IRS uses approximately 62 telephone lines agencywide that encompass what the agency calls their Enterprise system. The Taxpayer Advocate has consistently set goals to improve levels of service (LOS) to taxpayers at 85% of incoming calls. The 2022 report noted that only 11% of taxpayer telephone calls were answered by a live human in 2021 and another 14% were answered with automated assistance leaving Enterprise LOS at a paltry 25% well below the LOS goal of 85%. If you were among those who tried to call, you know this to be true. Often the phone rang unanswered. If the system did pick up, it was common to get a computerized message referring to high call volume and asking you to call back later before unceremoniously disconnecting. In 2022 the IRS disconnected over 74 million callers. While again, 2023 showed significant improvement, it was still only 29% of calls that were answered by a real person, 18% answered with automated assistance reaching a total LOS of 51%, and 16.3 million calls were still disconnected by the IRS.

Many frustrated taxpayers sought an escape in the form of in-person service but found little relief. Many taxpayers were surprised to discover they needed to schedule an appointment to receive in-person assistance, sending them back to their phones for scheduling. According the 2022 report, only about 11% of the 10.8 million callers attempting to schedule in-person appointments were answered. Of those only 57.8% were granted an appointment representing roughly 6.4% of total callers. Limited IRS office hours and staff availability were listed as the primary causes for this gap in service.

All of these service issues that encumbered the IRS in 2021, 2022 and 2023 were problematic with IRS staff levels ranging between 80 and 90 thousand. A 20% reduction of these staff levels isn’t likely to help, especially considering that the technological issues remain. Add to this the possibility that over 100 brick-and-mortar IRS Service Centers, which exist primarily to assist lower-income taxpayers without access to electronic filing alternatives and for whom paid-professional assistance is cost-prohibitive, will be shuttered.

The one bright spot in all of this, depending on your vantage point, is that an already hamstrung IRS likely cannot afford to ramp up taxpayer examinations. According to the SOI reports, in 2017, the year of lowest staffing levels in the last 30 years, the IRS performed approximately 728,000 audits of individual taxpayers and 76,000 audits of other taxpaying entities representing about .5% of all individual returns filed, and even less than that for other filers. These examinations resulted in the recovery of over $14,680,600,000 in revenues for the federal government. In 2023, with increased staff, they performed about 955,300 individual examinations and 108,700 audits of other taxpaying entities, representing .5% or less of all returns filed and recovering almost $25,000,000,000 in revenue.

While no one wants to be audited, it is important to remember that also means less recovered tax dollars to fund the government. A reduction in audits leads to concerns about a reduction in compliance. Will taxpayers file honestly if the threat of examination is diminished? We cannot know. What we do know is the IRS will need to be strategic in their choice of future audit targets. Random selection is likely to wane.

So, is this a good thing for taxpayers? For the government? I guess only time will tell because my Magic 8 ball sure isn’t saying. I can tell you that before you sit down to call the IRS, get yourself a protein bar and your caffeine of choice and make sure your phone is fully charged. It’s going to take a while.

Shanon Carlson, CPA & Tax Partner

[1] IRS Must Follow Contract Before Mass Layoffs Begin – National Treasury Employees Union – NTEU

[2] SOI Tax Stats – IRS Data Book | Internal Revenue Service

[3] Outdated and Old IT Systems Slow Government and Put Taxpayers at Risk | U.S. GAO

[5] 2022 Most Serious Problems – Taxpayer Advocate Service