Governmental Accounting Standard Board (GASB) Statement No. 103, Financial Reporting Model Improvements, supersede several paragraphs of GASB Statement No. 34, Basic Financial Statements—and Management’s Discussion and Analysis—for State and Local Governments, and other guidance, including implementation guides, related to the current financial reporting model.

The requirements of Statement No. 103 are effective for fiscal years beginning after June 15, 2025 (i.e., FY 2026 for June 30 year-end governments), but governments are encouraged to early implement it.

In this article we are going to address most of the new requirements included in Statement No. 103.

Unusual or Infrequent Items

The consideration and presentation of special items or extraordinary times, as previously required under Statement No. 34, has been refocused and replaced with the requirement to present unusual or infrequent items. The financial statements should present separately, before the change in fund balance or change in net position, those items that are considered unusual in nature or infrequent in occurrence.

The information regarding whether an item was within the control of management (one of the relevant characteristics for an item to be considered a special item under Statement No. 34), should be conveyed through a disclosure in notes to financial statements.

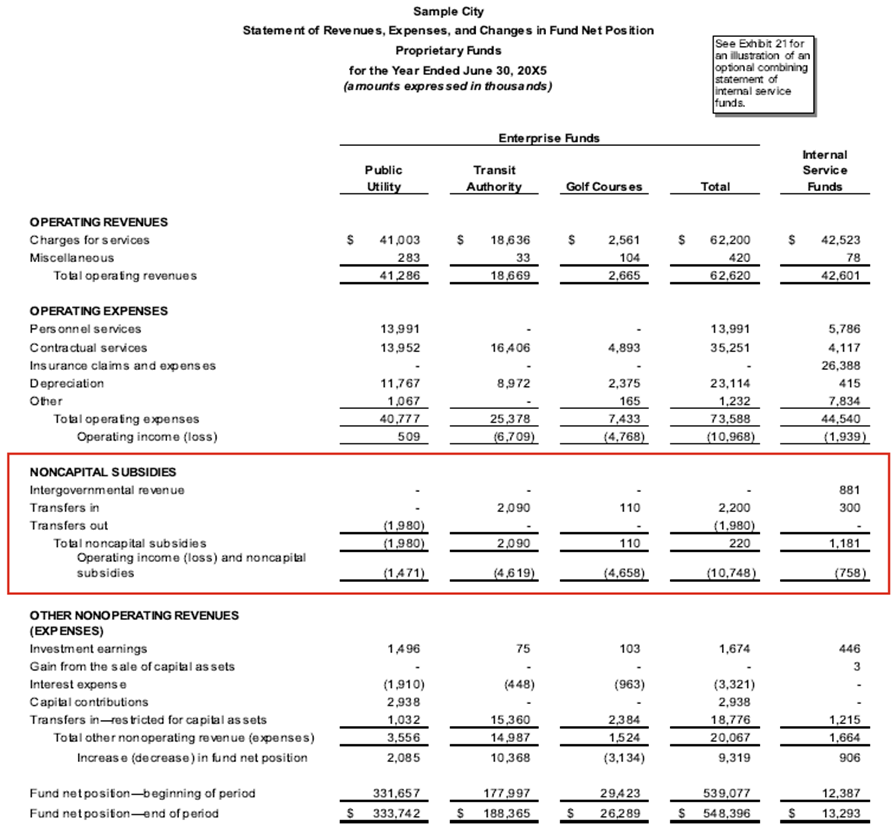

Proprietary Fund Statement of Revenues, Expenses, and Changes in Fund Net Position

Statement No. 103 requires that the proprietary fund statement of revenues, expenses, and changes in fund net position continue to distinguish between operating and nonoperating revenues and expenses. In this context, the Statement provides a definition of nonoperating revenues and expenses. Then, it defines operating revenues and expenses as those other than nonoperating revenues and expenses.

Nonoperating revenues and expenses are defined as:

- subsidies received and provided,

- contributions to permanent and term endowments,

- revenues and expenses related to financing,

- resources from the disposal of capital assets and inventory, and

- investment income and expenses.

In addition, Statement No. 103 requires that a subtotal for operating income (loss) and noncapital subsidies be presented before reporting other nonoperating revenues and expenses.

Subsidies are defined as:

- resources received from another party or fund (a) for which the proprietary fund does not provide goods and services to the other party or fund and (b) that directly or indirectly keep the proprietary fund’s current or future fees and charges lower than they would be otherwise,

- resources provided to another party or fund (a) for which the other party or fund does not provide goods and services to the proprietary fund and (b) that are recoverable through the proprietary fund’s current or future pricing policies, and

- all other transfers.

The following is an illustrative example of this requirement, and is included in Appendix C of Statement No 103:

This illustrative example does not present a section for unusual or infrequent items. But, if unusual or infrequent items were applicable to the reporting government, those would need to be presented within a separate section prior to the net change in net position.

Major Component Unit Information

Under the requirements of Statement No. 103, governments must present each major component unit using one of the following two formats:

- Separately in the face of the financial statements (i.e., the reporting entity’s statement of net position and statement of activities), if it does not reduce the readability of the statements.

- If the readability of those statements would be reduced, combining statements of major component units should be presented after the fund financial statements.

The old guidance allowed for a third option to present condensed financial statements of major component units in the notes to the financial statements. That third option is no longer allowed under Statement No. 103.

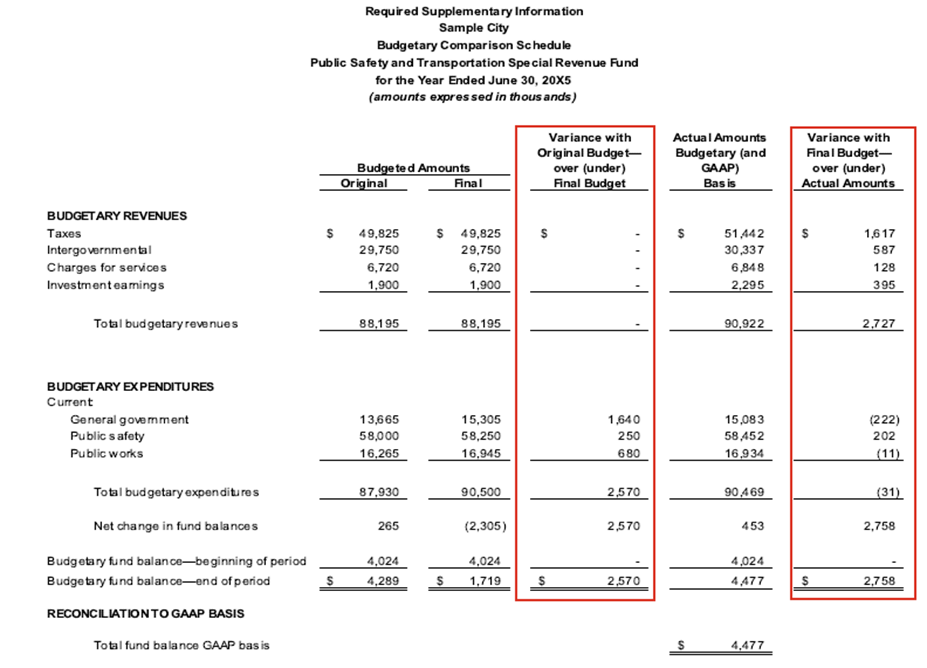

Budgetary Comparison Information

The budgetary comparison information of the general fund an of any major special revenue fund that has a legally adopted budget should be presented using a single method of communication, which is required supplementary information (RSI). The option to present the budgetary comparison information as a basic financial statement will not be permitted upon the adoption of Statement No. 103.

Governments also are required to present (1) variances between original and final budget amounts and (2) variances between final budget and actual amounts.

The following is an illustrative example of such requirement included in Appendix C of Statement No. 103.

Also, an explanation of significant variances will be required to be presented in the notes to RSI.

Management’s Discussion and Analysis (MD&A)

Statement No. 103 requires that the information presented in the MD&A be limited to the related topics discussed in paragraph 8 (i.e., Overview of the Financial Statements, Financial Summary, Detailed Analyses, Significant Capital Asset and Long-Term Financing Activity, and Currently Known Facts, Decisions, or Conditions.)

In various paragraphs, Statement No. 103 addresses the importance of providing in the MD&A clear explanations of the significant changes in financial position and result of operations, as follows:

- In paragraph 4 of the Statendard, it states that the MD&A should be written in a manner that can be understood by users who may not have a detailed knowledge of governmental accounting and financial reporting.

- In paragraph 5, the Standard requires a discussion of activities that had a significant positive impact or significant negative impact in the government balances and results of operations. It follows by explaining that the analysis should assist users in understanding why balances and results of operations reported in the current year’s financial statements changed from the prior year rather than simply presenting the amounts or percentages by which they changed.

- In paragraph 8.c., the Standard emphasizes that the Detailed Analysis over the changes in financial position and result of operations should include facts, decisions, or conditions about which the user may not be aware, with the understanding that not all users may be from the government’s geographical area.

Other Topics

Statement No. 103 includes other requirements over the MD&A and the Statistical Section that are not addressed in this Article. We encourage all prepares of the financial statements to read Statement No. 103 and its appendixes to become aware of all new requirements.

Final Thoughts

Some governments may find the requirements over the level of discussions that should be included in the MD&A to be the most time-consuming requirement when implementing Statement No. 103. Considering the nature of its financial reporting requirements, some of which are just specifying where to display some of the information that was already reported (for example, the display of noncapital subsidies by proprietary funds, the display of major component units, and the display of budgetary comparison schedules), governments may reasonably consider early implementing the requirements of this Statement.