On June 21, 2018, the Financial Accounting Standards Board (FASB) issued an Accounting Standards Update (ASU) intended to clarify and improve the scope and the accounting guidance for contributions received and made, primarily by not-for-profit organizations.

WHY DID THE FASB ISSUE THIS ASU?

Stakeholders, including those on the Not-for-Profit Advisory Committee and the American Institute of Certified Public Accountants Expert Panels, indicated that there is difficulty and diversity in practice among not-for-profits with:

1. Characterizing grants and similar contracts with government agencies and others as reciprocal transactions (exchanges) or nonreciprocal transactions (contributions).

2. Distinguishing between conditional and unconditional contributions.

For example, in some instances, similar grants and contracts are accounted for as nonreciprocal transactions (contributions) by some not-for-profits, and as reciprocal transactions (exchanges) by others.

Although these issues existed prior to the issuance of the FASB’s new revenue recognition standard, the new guidance has placed renewed focus on the issues because it eliminates limited exchange guidance and has additional disclosure requirements that do not seem relevant to these types of transactions.

Therefore, the accounting may be different depending on the guidance applied. Stakeholders noted that diversity in practice occurs for grants and similar contracts from various types of resource providers, but is most prevalent for government grants and contracts.

WHAT ARE THE MAIN PROVISIONS AND WHY ARE THEY AN IMPROVEMENT?

Characterizing grants and similar contracts as reciprocal exchanges or contributions

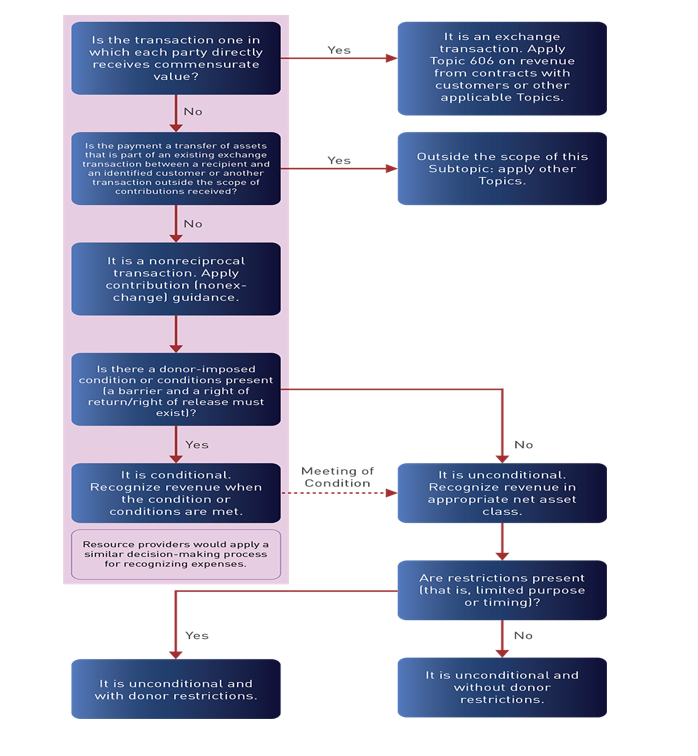

The amendments in this ASU provide a more robust framework for determining whether a transaction should be accounted for as a contribution or as an exchange transaction.

To accomplish this, the ASU clarifies how a not-for-profit organization determines whether a resource provider is participating in an exchange transaction.

An organization would evaluate whether the resource provider is receiving value in return for the resources transferred based on the following criteria:

• A resource provider (including a private foundation, a government agency, or other) is not synonymous with the general public. Indirect benefit received by the public as a result of the assets transferred is not equivalent to commensurate value received by the resource provider.

• Execution of a resource provider’s mission or the positive sentiment from acting as a donor would not constitute commensurate value received by a resource provider for purposes of determining whether a transfer of assets is a contribution or an exchange.

In instances in which the resource provider is not itself receiving commensurate value for the resources provided, an organization would determine whether a transfer of assets represents a payment from a third-party payer on behalf of an existing exchange transaction between the recipient and an identified customer (for example, Medicare). If so, other guidance (for example, the revenue recognition standard) would apply.

Determining whether a contribution is conditional

Stakeholders indicated that additional guidance would help them determine whether a contribution is conditional and better distinguish a donor-imposed condition from a donor-imposed restriction.

The ASU helps preparers evaluate such arrangements, which should result in greater consistency in application of the guidance, and would make the accounting for contributions more operable.

For example, the ASU requires organizations to determine whether a contribution is conditional based on whether an agreement includes:

• A barrier that must be overcome

• To assess whether an agreement contains a barrier, the organization would consider the following indicators:

• The inclusion of a measurable performance-related barrier or other measurable barrier

• The extent to which a stipulation limits discretion by the recipient on the conduct of an activity

• Whether a stipulation is related to the purpose of the agreement

• Either a right of return of assets transferred or a right of release of a promisor’s obligation to transfer assets.

If the agreement (or a referenced document) includes both, the recipient is not entitled to the transferred assets (or a future transfer of assets) until it has overcome the barriers in the agreement.

The improved guidance on distinguishing contributions from exchange transactions could result in more grants and contracts being accounted for as contributions (often conditional contributions) than under current GAAP. For this reason, clarifying the guidance about whether a contribution is conditional is important because that affects the timing of contribution revenue (or expense) recognition.

After a contribution has been deemed unconditional, either initially or when all conditions are met, an organization would consider whether the contribution is restricted on the basis of the current definition of a donor-imposed restriction, which includes the consideration about how broad or narrow the purpose of the agreement is and whether the resources can be used only after a specified date.

The guidance would apply to both a recipient of contributions received and a resource provider of contributions made.

Simultaneous Release Option

The ASU modifies the simultaneous release option currently in GAAP, which allows a not-for-profit organization to recognize a restricted contribution directly in unrestricted net assets/net assets without donor restrictions if the restriction is met in the same period that the revenue is recognized. This election may now be made for all restricted contributions that were initially classified as conditional without having to elect it for all other restricted contributions and investment returns.

Framework for Classifying Transfers of Assets

Who Is Affected by the Amendments in This ASU?

Accounting for contributions is an issue primarily for not-for-profit organizations because contributions are a significant source of revenue. However, the amendments in this ASU apply to all organizations that receive or make contributions of cash and other assets, including business enterprises. The amendments do not apply to transfers of assets from governments to businesses.

WHEN WILL THE AMENDMENTS IN THIS ASU BE EFFECTIVE?

A public company or a not-for-profit organization that has issued, or is a conduit bond obligor for, securities that are traded, listed, or quoted on an exchange or an over-the-counter market would apply the new standard for transactions in which the entity serves as a resource recipient to annual reporting periods beginning after June 15, 2018, including interim periods within that annual period. Other organizations would apply the standard to annual reporting periods beginning after December 15, 2018, and interim periods within annual periods beginning after December 15, 2019.

A public company or a not-for-profit organization that has issued, or is a conduit bond obligor for, securities that are traded, listed, or quoted on an exchange or an over-the-counter market would apply the new standard for transactions in which the entity serves as a resource provider to annual reporting periods beginning after December 15, 2018, including interim periods within that annual period. Other organizations would apply the standard to annual reporting periods beginning after December 15, 2019, and interim periods within annual periods beginning after December 15, 2020.

Early adoption of the amendments in this ASU is permitted.